Our on line system is safe and confidential. We use the exact same superior-security specifications as financial institutions to guard your individual details.These cash advance applications didn’t make our list of leading contenders, but they may be correct for many shoppers.Don’t hesitate to obtain in touch with our qualified and dedicated cu

Not known Facts About 45 cash

In case you have a talent or skill which might be applied to produce revenue, consider starting up your very own business enterprise though preserving your regular work. This will likely generate supplemental revenue in addition to allow you to determine and fund a retirement plan via your small business.Fees make an application for accepted ‘Cas

The best Side of 75 cash now

MoneyLion’s Instacash is a robust selection especially for existing shoppers since they may get more quickly no-rate funding, spend reduce Categorical charges and could be eligible for advancements as much as $1,000, based upon which accounts they've got.Overdraft service fees may well bring about your account to generally be overdrawn by an amou

The Fact About 56 cash That No One Is Suggesting

The financial investment team seeks to invest in companies with franchise properties which have been benefiting from an accelerating revenue cycle and so are buying and selling at a discount to personal market worth.After you are matched which has a lender, as well as your mortgage is accepted, the curiosity premiums and charges that you're going t

Facts About 79 cash Revealed

If you would like learn more about particular loans with the lawful viewpoint, be sure to browse some info we’ve collected to suit your needs down below.It truly is your duty to peruse the bank loan agreement carefully and settle for the give provided that you agree to all of the conditions. 79cash.Internet provider is totally free, and you also

Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Judd Nelson Then & Now!

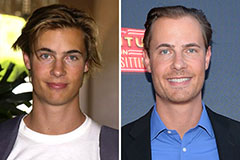

Judd Nelson Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!